www.magazine-industry-usa.com

10

'25

Written on Modified on

How smart automation is making US battery production more efficient

With smart automation and digitalization from KUKA, all stages of battery production can be made more efficient – without sacrificing “Made in the USA” quality.

www.kuka.com

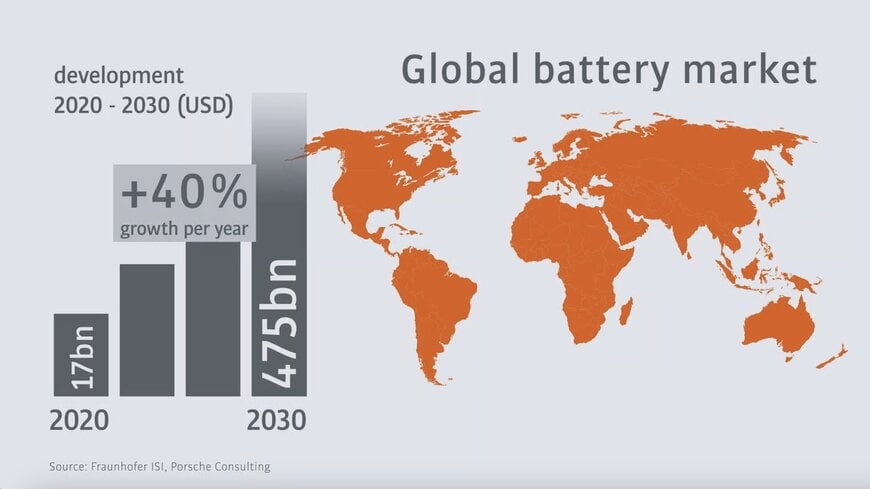

According to current studies, the global battery market will grow by around 40% annually until 2030. However, US battery manufacturers and suppliers must invest in development, expertise and new technologies in order to keep up with the Asian competition. This is all the more important in view of the strengthening of local value chains. Successful use cases from practice and research show this: With smart automation and digitalization, all stages of battery production can be made more efficient – without sacrificing “Made in the USA” quality.

Battery cell production in the USA will increase 28-fold by 2032

Electric cars are one of the most important drive technologies for emissions and batteries are the key to achieving this. According to forecasts by the German research institute Fraunhofer ISI, around 40% of all newly registered cars worldwide will be electric by 2030, and more than half by 2035. This means that the demand for batteries is growing: According to a study by Porsche Consulting for the German Engineering Federation (VDMA), the global battery market will grow rapidly from 20 billion euros in 2020 to 550 billion euros by 2030, with annual growth of 40%.

Accordingly, the USA is investing heavily in the expansion of its own battery industry in order to localize value chains and reduce dependence on imports, particularly from China. A study by the International Council on Clean Transportation (ICCT) shows that the tax incentives and the expansion of production will lead to significant employment effects and and strengthen the competitiveness of the US location. Experts expect battery cell production in the USA to increase 28-fold by 2032. By 2030, production capacities in North America will exceed 1,300 GWh/year, enough for around 10 million electric vehicles per year. Numerous new gigafactories are being built, supported by billions in public and private investment.

However, in order to receive the full tax credits for electric vehicles (EVs) from the US government, manufacturers must meet strict local content requirements: From this year, 60% of the value of battery components must come from North America, with the targets rising to 80% by 2027 and set to increase to 100% by 2030. Companies such as BMW are therefore focusing on the “local for local” principle: suppliers, producers and buyers are brought together geographically to increase efficiency, security of supply and sustainability. One example is the cooperation between Umicore (Canada) and AESC (South Carolina), which ensures a regional supply of cathode materials and thus strengthens the North American supply chain.

Sustained market expnasion is driven by rapid e-mobility growth, expecting 40% of newly rgistered cars to be electric by 2030.

Import duties will have a long-term effect – and force companies to modernize their production facilities

The new US tariffs on imported battery cells this year will also have a further effect on strengthening domestic battery cell production, albeit in the long term. Effective tariffs of 64.9% on battery cells now apply to China, and 24 to 25% for Japan and South Korea. In the short term, the tax measures will lead to higher costs for locally produced batteries, as many raw materials will also have to be imported. According to argusmedia, the leading independent provider of market intelligence to the global energy markets, this will increase import costs for US car manufacturers and battery producers by around 8 billion per year USD.

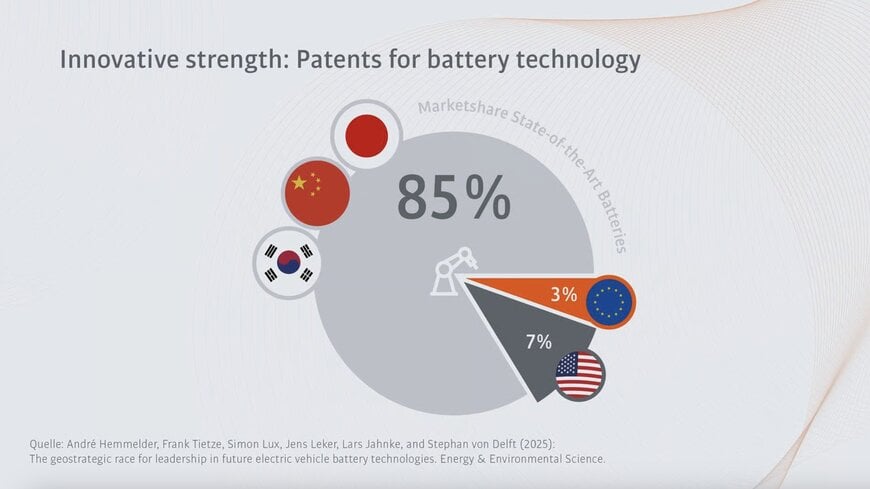

In the long term, battery production will increasingly shift to the USA, even if it will take several years to build up new capacities. More than ever, US battery production companies are therefore forced to invest in development, expertise and new technologies. This is made clear by a recent study conducted by the Universities of Münster and Cambridge together with the german Fraunhofer Institute for Battery Cell Research (FFB). The researchers compared patents and innovation strategies from China, Japan, South Korea, Europe and the USA. The result: Asia leads with its speed and technology, while Europe and the USA are in danger of falling behind. The reason for this is their hesitant innovation policy and lack of investment in key technologies. According to the researchers, while Asia is systematically focusing on future technologies, Europe and the USA are primarily concentrating on existing lithium-ion technologies. This is jeopardizing their competitiveness, both in high-energy batteries and cheaper alternatives, especially against the backdrop of increasingly scarce raw materials for conventional batteries. “Europe and the USA should rapidly ramp up their investments in future battery value chains and promote the transfer of knowledge and technology with leading battery developers and manufacturers from Asia,” advises business chemist Prof. Dr. Stephan von Delft from the University of Münster.

The International Council on Clean Transportation (ICCT) points out that only extensive automation will enable domestic battery plants to compete with established international manufacturers – especially those in Asia, which already benefit from economies of scale and advanced manufacturing processes. While automation reduces the number of manual tasks, it also creates new, higher-skilled jobs in engineering, maintenance and plant operations. Automated battery production facilities could support a robust domestic workforce by shifting demand for labor to technical and supervisory roles, strengthening the local labor market and promoting economic development.

Patents for battery technology: Asia is far ahead with China, Japan, and South Korea. Europe and the USA are lagging behind (as of March 2025).

While Asia still dominates battery production, the USA can catch up – through modernization and cooperation

As various current studies – e.g. by the Capgemini Research Institute – show, the majority of battery producers worldwide are extremely ill-prepared for the next generation of battery cells. Many production facilities no longer meet the technological standards required for future requirements. In order to remain competitive, companies must fundamentally modernize or even completely rebuild their production facilities.

“Technological advances along the entire battery value chain will reshape the entire industry and offer great potential for new use cases,” says Michael Müller, Head of Climate Tech & Sustainability at Capgemini Engineering in Germany. “In this time of change, the German and European battery industry in particular must catch up with the Asian market leaders and develop its own differentiating features.” Digital technologies are becoming increasingly important along the entire battery value chain. From quality control to life cycle management and recycling: data-based systems and smart automation solutions offer enormous potential to increase efficiency and sustainability. At the same time, it is clear how important it is for everyone involved to work closely together – from industry and research to regulatory authorities. Only through networked innovation ecosystems can the transformation towards sustainable, battery-based mobility be truly shaped. Many industry experts believe that much more cooperation is needed in order to compete with Asia and, above all, to achieve a competitive edge in module and battery pack assembly. This is because the music in battery production is currently still clearly being played in Asia, where around 90 percent of the market share of machines and equipment for battery production is located.

Digital solutions reduce emissions, waste and costs – and guarantee high quality “Made in the USA”

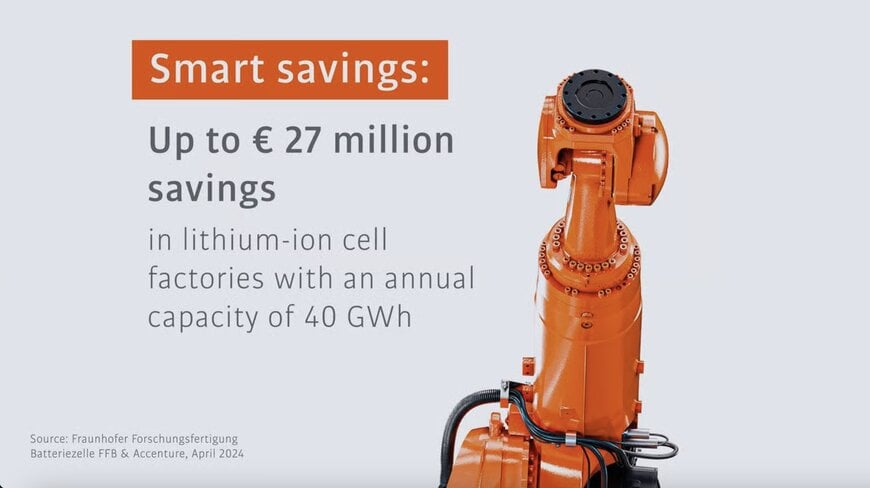

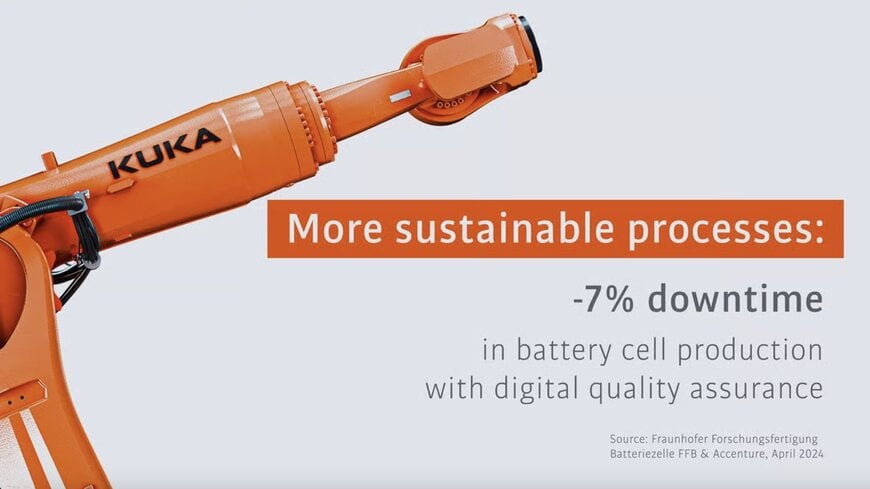

One key to catching up: digital solutions. A lithium-ion cell factory with an annual capacity of 40 gigawatt hours can save up to 31 million dollars a year simply by using digital solutions in battery production. This is the result of a joint study by the german Fraunhofer Institute for Battery Cell Research FFB and Accenture. In addition to the cost benefits, the CO₂ emissions can be reduced by 10%. According to the study, digital quality systems also reduce reject rates by up to 10%. This results in noticeable savings, particularly in material costs, which account for 70% of production. At the same time, digital optimization saves up to 9.5% on energy – the key for almost 10% fewer emissions. And predictive maintenance reduces downtimes by over 7%.

The European research project FULL-MAP, which was launched in spring 2025, also uses artificial intelligence, big data and autonomous synthesis to accelerate the development of sustainable batteries. The aim is to establish an interoperable data framework for the structured collection and sharing of information on battery materials and interfaces. In addition, flexible design and simulation tools, improved analysis methods and AI-controlled, autonomous synthesis robots will be developed to enable efficient production and data-based optimization of novel materials.

Mini-environments significantly reduce energy consumption

Another solution is mini-environments: by enclosing production facilities, cleanliness, temperature and humidity are specifically controlled in a local environment to create ideal conditions for sensitive process steps. This could make large and energy-intensive clean and dry rooms obsolete and significantly reduce energy consumption. A recent study by Fraunhofer ISI from June 2025 shows the enormous savings potential of mini-environments. The authors state that solutions of this kind are primarily in the testing or pilot phase still. However, there are already initial application examples in the industry. They expect a broader market launch by 2028 at the latest.

At the wbk Institute of Production Engineering at the Karlsruhe Institute of Technology (KIT), this potentially future-oriented battery production can already be experienced. As part of the AgiloBat project, researchers have developed an agile cell production system for lithium-ion batteries. With the help of robot-based automation in mini-environments, a level of flexibility was achieved that was previously only possible in the factory. Thanks to adaptable processes and program changes, a wide variety of cell geometries can be produced in the drying room without having to make costly changes to the system. The researchers developed special robot cells for this purpose, which are a world first in terms of their design and construction. “The individual production process steps and the associated machines are enclosed and the filtered air is brought directly to the process,” explains Nicole Neub, Director of Battery Technology at Exentec, who designed the robot cells. “This means that only the machine is supplied with clean and dry air and not a large unused volume in the production hall.”

As part of AgiloBat, four KR CYBERTECH nano robots, one KR 4 AGILUS and two KR SCARA units from KUKA are in operation for cell stacking. “Battery cell manufacturers have been using KUKA robots in the dry room for years to reduce environmental contamination by employees and increase production quality,” says Thomas Schmidberger, Business Development Manager at KUKA. The application in the drying room poses special challenges for the robots. For example, the low humidity can lead to increased wear, especially on materials that contain plasticizers, such as seals or cable connections. “We wanted to build a system with maximum flexibility by mapping different process steps using different production modules and then linking them together,” explains Sebastian Henschel, Technical Manager for AgiloBat. “The robots from KUKA have absolutely proven themselves here. With their help, we have achieved industrial repeatability and accuracy, combined with a flexibility that we are otherwise only familiar with from manual production.”

Above all, however, the production processes used at AgiloBat can save considerable resources. On the one hand, significantly less energy is required than in conventional production – after all, between 25 and 40% of the total energy requirement in the gigafactories is used just to create dry room conditions. The running costs for this, i.e. OPEX, can be significantly reduced with mini-environments. And secondly, waste is significantly reduced.

Flexible and modular production system adapts to short and dynamic iteration cycles

For more than ten years, KUKA has been optimizing its product portfolio to meet the special requirements that must be fulfilled in the manufacturing of electronic components for the automotive industry and has placed a particular focus on battery production. The German automation group partners with some of the world's largest battery manufacturers as well as system integrators of battery production systems. However, KUKA can also rely on its in-house integrator KUKA Systems.

This was recently successfully achieved at MAN Truck & Bus: in April 2025, the Munich-based commercial vehicle manufacturer launched its battery production in Nürnberg. KUKA Systems was responsible for the planning and construction of the entire hall and relied on a modular system: The system works without a conveyor belt and cycle, so it can handle different product variants and can be easily adapted to new variants. The decoupled stations can also be operated independently. The battery packs flow through the production system depending on the individual requirements and condition. This is made possible by a high degree of digitalization and automation in the production flow. The provision of materials is also fully automated with intelligent networked autonomous mobile robots (AMR). Here, 35 KMP 3000P platforms from KUKA are in use. MAN can currently produce 50,000 battery packs per year, but the new building is designed for up to 100,000 units per year.

This demonstrates the strengths of KUKA's technologies in battery production: flexibility and modularity. These are also urgently needed in order to remain competitive. This is because today's iteration cycles in battery production are extremely short and dynamic. It is not uncommon for the first changes to the product to be made during the tendering phase, with further adjustments often becoming necessary when the order is placed and during commissioning. “If you don't rely on a flexible and modular project architecture, in the worst case you end up with ghost halls and bad investments in the tens of millions,” says Thomas Schmidberger, Global Business Development Manager at KUKA.

Untapped potential through automation in battery logistics

Automation also plays an indispensable role in the logistics of battery production and also holds considerable potential for optimization: “Battery logistics is a cornerstone for the successful expansion of e-mobility,” emphasizes Arkadius Schier, head of the research project “Innovation Laboratory for Battery Logistics in the Battery Industry”, at the german Fraunhofer Institute for Material Flow and Logistics IML, which was completed in March 2025.

Accordingly, KUKA is also focusing on AMR solutions for battery logistics, both for material transport to the line and in process interlinking within production. “For our customers, the simple operation and integration of our vehicles are extremely important to us,” reports Dominik Haas, Head of Business Unit AMR at KUKA. Standardized hardware and software as well as openness for agnostic fleet management systems make it easier for users to deploy the transport systems in areas that were previously difficult or impossible to automate. Increasingly variable battery systems are also increasing the need for a more flexible material flow in logistics. By analysing large volumes of data and identifying patterns, AI systems can also optimize workflows and increase efficiency here. This is particularly valuable in logistics, as the optimization of routes and the efficient distribution of tasks can lead to considerable cost savings.

Flexible automation solutions adapt to different battery models for battery recycling

As the number of e-vehicles grows, so does the mountain of used batteries. As the raw materials for their production are becoming increasingly scarce, the focus is shifting more and more to battery recycling and here too, intelligent automation is the key to solutions that are as sustainable as they are economically viable.

For example, the German Fraunhofer Institute for Manufacturing Engineering and Automation IPA successfully tested the industrial disassembly of batteries and electric motors under real-life conditions in the “DeMoBat” project: A KR QUANTEC carried out a wide variety of work steps – from loosening screws and opening sealing joints to disconnecting cables. It was also taken into account that an unbelievable number of different battery systems can be installed on are on the market. As a six-axis robot, the KR QUANTEC is just right here: with its six degrees of freedom, it can adapt optimally to the different dimensions and geometries of the respective battery system and, thanks to its load capacity, can also cope with high torques.

The complication is that car manufacturers have to fit as many components as possible into the batteries in the smallest possible space, says Anwar Al Assadi, group leader at Fraunhofer IPA. This extremely restricts the scope for movement during disassembly. Other challenges include the varying position of cables or the many bonded joints in a battery, which are much more difficult to remove automatically than screws. However, the IPA has also found automation solutions for this, which are now being further developed for industrial use. “It is crucial to build flexible systems,” emphasizes Al Assadi, “not least because the design of the batteries changes fundamentally every six months or so.”

Flexibility as a competitive factor: Why agile automation is the key to the future of US battery production

Whether assembly, recycling or logistics: US battery manufacturers rely on integrated, flexible and modularly scalable automation solutions in order to meet the increasing demands on quantities, quality and sustainability. Smart technologies and a forward-looking project architecture enable manufacturers to remain successful in the long term in a highly dynamic market environment and at the same time ensure the necessary flexibility for future leaps in innovation.

At the same time, the US battery industry must rapidly expand its production capacity to meet ambitious domestic content and supply chain security targets. Automation is key to achieving this scale efficiently and within competitive timelines. Manual production methods are simply not capable of producing the required volumes or consistency at the necessary speed. Automated systems can produce battery packs, modules and cells on a scale and with a level of efficiency that manual processes cannot achieve.

In this respect, further automation in US battery production is not just a cost-cutting tool, but the backbone of a competitive, scalable and resilient domestic battery industry. Only this will enable US manufacturers to compete on an equal footing with global leaders, especially Asian companies, in terms of efficiency, quality and performance.

www.kuka.com